The Taxing Reality: Landlords Should Beware of Capital Gains Consequences

This year, more than 135,000 taxpayers will discover the perils of Capital Gains Tax on residential properties – creating a windfall for the treasury and a hole in their pockets.

Selling a rental property is often a finely balanced decision, and the impact of a lump sum heading in the direction of HMRC should not be discounted.

Whilst some landlords are looking to divest themselves of properties that seem at present to be marginally profitable, there are many factors to consider, not least the possibility of continued capital appreciation.

Recently, one of our landlord clients popped in for a chat about selling their property. They were near to a sale and wanted to know how much they would be left with after paying CGT.

The plan was to transfer the profit to a savings product, collect the interest, and never have to darken a rental agent’s doorway again.

It was a simple question with a simple answer…… the £50k profit in the property netted down to £31,680 after transaction costs and tax were paid. (In this instance higher rate tax, but still a shocker).

Our client needed a moment to compose themselves.

After administering a strong cup of tea, we took a moment to compare their position if they were to hold the property.

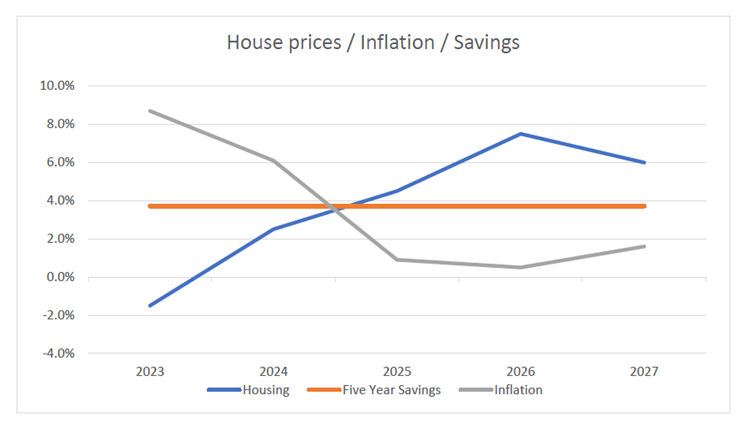

With a bit of imagination, we had a look at available data and came up with some forecasts to play with – data sources included Savills, the Bank of England, Statista, and Mabel, the office pooch.

We came up with this chart:

We then applied the forecasts above to their property to have a look at the position in the future and came up with this: Another Chart!

So, the calculation showed a £41,000 improvement in profit by holding for five years. In this case, the client was at 80% LTV and so leverage significantly improved their profit over time.

Mabel, the office dog, recommended that the client hold the property, and they agreed.

Each property is different, and everyone will have their own ideas on what the future will hold.

It is strongly recommended that you fully consider your CGT and Personal Tax position before taking a decision to dispose of a rental property. Look before you leap!

There are other reasons to hold onto your property:

· Relatively low savings rates

· High inflation

· Opportunities to reprice

· Reduction in financial security

· Weaker selling prices

· Difficulty in re-entering the market

· Cost of re-entering the market – SDLT

We’d be happy to discuss any aspect of this article with you, and to look at your own circumstances to see if selling or holding will work best for you.

If you would like to get professional advice on your personal circumstances you can contact your local Property Management team.

For personal tax advice you can contact James, Director at Tax Bees on 01244 563 700, or visit https://taxbees.co.uk

P.S. If you decide to sell, you only have 60 days post-completion to let HMRC know about it – we can help with CGT Returns and with keeping your tax liability to a minimum.

James Dean

Director, Tax Bees

Subscribe to our Newsletter

Get the latest news from Julian Wadden direct to your inbox.

Unsubscribe at any time. For more about how we use your information, see our Privacy Notice.